Alongside its impressive annual results statement yesterday, the CEO of Tesco vowed to support shoppers “in their hour of greatest need” by continuing its price battle with Aldi, Lidl, and other discounters.

"(Consumers) are already planning changes to the way they shop, and we will make sure that we will be there to support them."The group noted that the final outcome depends on customer shopping habits, cost inflation levels in the months ahead, and the extent to which rising costs are absorbed or passed on to consumers.

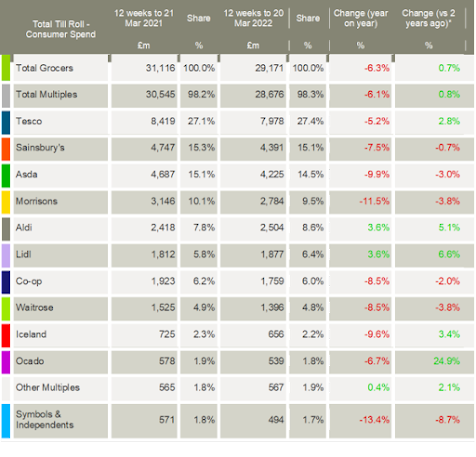

Murphy highlighted that Tesco was managing to keep price inflation in its stores a “bit under the number for the overall market” as it battles the discounters that are gaining share by attracting cash-strapped shoppers.

Tesco have really strong levers through the Aldi price match, low everyday prices and Clubcard prices

He also noted that it was offering competitive prices on thousands of household and beauty items to stop customers from going to fast-growing chains such as Home Bargains and B&M.

“We plan to make sure we stay close to the situation and offer no reason to go anywhere else from a price competition point of view,” Murphy said. “That’s our commitment and that’s unwavering regardless of what happens in the market.”

He declined to say whether the business would be cutting prices further or be forced to increase them.

“We stay close to our suppliers and work with them to manage their input inflation but we are very rigorous about making sure that we don’t accept any cost that would be unnecessary."

The bleak outlook sent shares in all the listed grocery retailers tumbling and comes just a week after Morrisons cautioned that its sales and profits would be affected by geopolitical and inflationary pressures.

Sainsbury’s shares lost 2.5%, whilst Marks & Spencer shares tumbled 2.1% and Ocado’s slipped 2.6%.

Shore Capital retail analyst Clive Black downgraded his recommendation for Tesco from ‘buy’ to ‘hold’, and added that if the supermarket catches a cold he would expect others to catch ‘influenza’.

AJ Bell financial analyst Danni Hewson added: “There is a real risk that cash-strapped families will cut back on their shopping and if this trend does play out as expected, it won’t just be Tesco feeling the pain.”

NamNews Implications:

NamNews Implications:

- Aldi price match, low everyday prices and Clubcard prices will help fight the other mults…

- Meanwhile, Tesco determination to offer no reason to go anywhere else from a price competition point of view…

- …spells continuing price war in 2022…

- …no matter what happens in the market.

- Listed retailers fell approximately 2% yesterday, reflecting inflation and other market factors.

- Meanwhile, little/no mention of discounters’ ability to fund UK price cuts via global businesses to grow share…

#PriceWars #Inflation #DiscounterShare