The name, pronounced “Hay-Lee-On”, was inspired by the merging of the words ‘Hale’, which is an old English word that means ‘in good health’ and Leon, which is associated with the word ‘strength’.

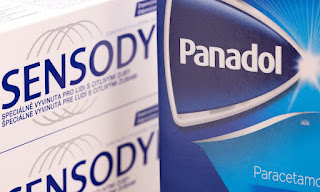

The demerger of the Consumer Healthcare business is planned to take place by mid-2022, creating a standalone entity with sales of around £10bn from brands such as Sensodyne, Voltaren, Panadol and Centrum.

Once separated from GSK’s pharmaceuticals and vaccines operations, the new company will be led by the unit’s current Chief Executive Brian McNamara and recently appointed Chairman Designate Sir Dave Lewis, the former boss of Tesco. Haleon will be headquartered at a new campus in Weybridge, which is expected to open at the end of 2024 and will include an R&D centre and a shopper science lab.

NamNews Implications:

- Combination of new name and ‘separate’ existence, ‘independent’ of group…

- …means more focus on consumer optimisation.

- Time for rivals to reassess relative competitive appeal…