#ExchangeRate #Dollar #Pound #Value

Thursday, 29 September 2022

Sterling-Dollar Exchange rate in perspective:

#ExchangeRate #Dollar #Pound #Value

Profits Slide At Aldi But Pledges To Prioritise Lower Prices Over Short-Term Gains

Over the year to 31 December 2021, Aldi’s operations in the UK and Ireland saw pre-tax profits fall 86.5% to £35.7m on sales up 0.9% to £13.65bn.

Aldi cited Covid-related costs, increasing staff pay and investment in prices. The small increase in sales came after the chain missed out on the online grocery boom during the pandemic.

“Preserving our price discount and rewarding our people will always be more important to us than short-term profit,” said Giles Hurley, CEO Aldi UK and Ireland. “Being privately owned means we can keep our promises even when times are tough.”

Aldi attracted 1.5 million extra customers over the past 12 weeks vs 2021 from supermarkets. This helped boost sales of the discounter’s Specially Selected own-label range by 29%.

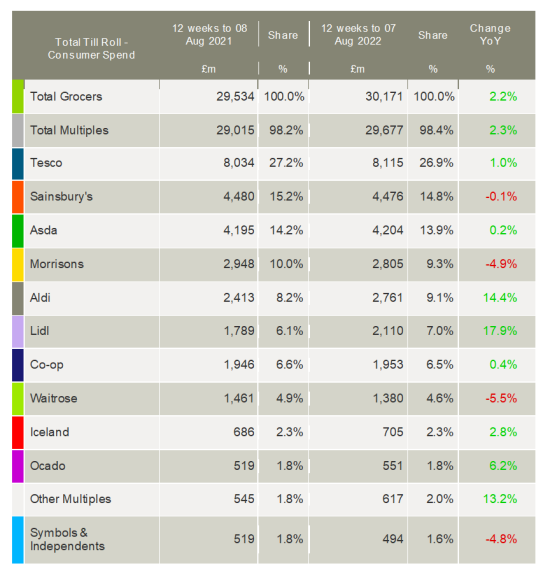

Kantar showed sales growing at 18.7%, overtaking Morrisons to No 4

Aldi buying teams were “working tirelessly to counter the impact of inflation and maintain its discount against traditional full price supermarkets”.

Aldi has over 970 stores, plans 16 more in the UK by 2023, to its target of 1,200 by 2025.

Other investment – part of its ongoing £1.3bn two-year pledge – will include expanding/relocating dozens of existing stores + developing its distribution centres and technology infrastructure.

Re cost-of-living crisis, Hurley said: “It’s also a time when Aldi comes into its own. From our carefully selected range to our smaller format stores to our trademark efficiency, we can leverage our unique approach for the benefit of all of our customers.

“We will do whatever it takes to maintain our discount to the traditional full-price supermarkets and keep grocery prices as low as possible..”

Unlike the big gains by discounters in 2008, Mults are price-matching discounter key lines and introducing expanded budget ranges.

Hurley said their private ownership allows a longer view and huge global buying power.

Also, Aldi’s efficient business model can insulate customers vs rising prices across the food supply chain.

NamNews Implications:

- Aldi are able and willing to take a profit-hit to grow share…

- …as they continue to operate ‘on a roll’ in the UK.

- And given that they rarely sacrifice share gains…

- …not a bad strategy.

- Suppliers and retail rivals need to watch for Lidl pursuing similar policies.

- Aldi and Lidl can afford to run at a loss, supported by their global operations…

- …for as long as it takes!

New Owner Of Morrisons Asks Staff To Invest In The Business

According to The Guardian, middle management level departmental heads had been asked by CD&R for £10,000 while the directors of departments had been asked for £25,000 each. The minimum investment required to participate is said to be £2,000.

The newspaper’s source said that while contributions were voluntary, some staff were annoyed about feeling pressed to make a contribution to the underperforming business at the time of a cost-of-living crisis. “People are used to being paid bonuses rather than asked to invest,” the source said.

However, those who have agreed to invest in shares in Morrisons were paid a special bonus, equivalent to 60% of the amount they were asked to invest.

A spokesperson for the retailer is quoted by The Guardian as saying: “The opportunity to invest in the future of Morrisons was incredibly popular throughout the business with over 800 colleagues, or more than 90% of those eligible, choosing to invest.”

One expert told the newspaper that it was common to ask staff to invest as part of private equity deals, with the stakes seen as an incentive to help the business grow.

He suggested that the wider-than-usual scope of the Morrisons scheme could be seen as a good thing, allowing more people to benefit from a potential return on their investment.

Morrisons, which was acquired in 2021 by the CD&R in a deal worth £7bn, has been losing sales amidst the tough trading conditions, with its market share slipping behind Aldi in recent months.

Surveys suggest its prices have become more expensive compared to key competitors in recent months, weakening its performance.

One industry insider is quoted by The Guardian as saying: “The numbers look grim. [The product] doesn’t look exciting and they have missed quite a lot of opportunities.”

The source suggested that suppliers were becoming disillusioned as volume of goods sold by the retailer fell back.

Following a competition regulators delay, Morrisons is fully controlled by its new owners.

After posting a fall in sales in June, CEO David Potts: “Now that the CMA process has concluded, we are looking forward to working more closely with CD&R as we continue to drive the key pillars of our strategy, focused on being a broader, stronger, popular and accessible business.”

NamNews Implications:

- By way of perspective, assuming that 800 staff invest an average £10k, means £8m invested.

- And assuming a 60% bonus on amount invested, a £10k investment would cost staff £4k…

- One way of getting skin in the game?

- Still, fingers crossed, we are all gambling now…

Thursday, 18 August 2022

Grocery Price Inflation Hits New Peak; Asda Returns To Growth And Discounters Prospering

Grocery price inflation hit 11.6% over the past four weeks, the highest level since Kantar first started tracking the data this way in 2008. Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “As predicted, we’ve now hit a new peak in grocery price inflation, with products like butter, milk and poultry in particular seeing some of the biggest jumps.

This rise means that the average annual shop is set to increase by a staggering £533, or £10.25 every week, if consumers buy the same products as they did last year.”

He added: “It’s not surprising that we’re seeing shoppers make lifestyle changes to deal with the extra demands on their household budgets. Own-label ranges are at record levels of popularity, with sales rising by 7.3% and holding 51.6% of the market compared with branded products, the biggest share we’ve ever recorded.”

With inflation high and a recession likely later this year, Kantar noted that comparisons against the last financial crisis are becoming visible. McKevitt said: “People are shopping around between the retailers to find the best value products, but back in 2008 there was much more of a reliance on promotions. It’s harder to hunt out these deals in 2022 – the number of products sold on promotion is at 24.7% for the four weeks to 7 August 2022, while 14 years ago it was at 30%. Instead, supermarkets are currently pointing shoppers towards their everyday low prices, value ranges and price matches instead.

“Over the past month, we’ve really seen retailers expand and advertise their own value ranges across the store to reflect demand. Consumers are welcoming the different choices and options being made available to them on the shelves, with sales of own-label value products increasing by 19.7% this month. As an example, Asda’s Just Essentials line, which launched this summer, is already in 33% of its customers’ baskets.”

- Not much about brands, folks?

- i.e. Brands need to fend off private label

- Meanwhile, Kantar clearly demonstrate that consumers are trading down, shopping around and are hungry for value…

- …with even higher inflation and recession to come.

- Discounters now have a collective share of 16.1%.

- Can you really afford not to pursue your fair share of Aldi & Lidl business?

Sunday, 14 August 2022

Fixing the UK Economy’s Cost-of-Living Crisis….

Last week, one of the political parties suggested that the UK Government should treat the cost-of-living crisis with a “wartime mentality” and thus sparked a thought here at NamNews as we focused on our perpetual search for practical solutions to Supplier-Retailer business problems…

Given the build-up of Cost-of-Living issues in the UK including soaring food-price inflation, product shortages and energy price increases all originating in Lockdown, followed by a succession of payment holidays for businesses (Rent, Rates, and Tax) and ‘Government’ i.e. taxpayer help via furloughs, all coming home to roost currently, it follows that some drastic action is required.

Moreover, think also of recent cost increases that have crept in as consumers borrowed to ease the pressure, with credit card borrowing growing at its fastest pace since 2005, with interest on cards costing an average 21.66% in July, rates for £10k personal loans rising in July to 4.18%, and overdraft rates still at all-time highs of 35.28%!

Others have attempted to explain how we have reached this point but much of the blame can be placed on the decision to move off the Gold Standard.

On August 15, 1971, the US came off the Gold Standard, causing other countries to follow suit and in the UK ‘a pound was no longer a pound’. In practice, this meant that Governments could print money at will (Quantitative Easing) and thus run up limitless Debt in the process. Cheap money lent recklessly via sub-prime mortgages resulted in the Global Financial Crisis of 2008 when the Banks were bailed out and became even more reckless….

At a Country level in terms of National Debt, anyone thinking this QE and low-interest freedom would be handled responsibly can easily put the issue in context by Googling ‘Interest paid on UK National Debt’ to find that the UK Interest Bill for June 2022 (one month!) was £19.4bn….

As a result of this Quantitative Easing, banks have been able to borrow at near-zero interest rates and charge consumers the rates outlined above. Unfortunately for all except Civil Servants on inflation-proofed pensions, Inflation began to increase, and as you know is predicted to shortly reach 13% by a very conservative Bank of England.

Taking all of the above into account, combining inflation with low growth, and low productivity, we believe we are headed into a recession that will last five years or more, thus requiring a “wartime mentality” on the part of the Government...

Speaking of wars, a recent chance discovery of a book by J K Galbraith ‘The World Economy Since the Wars’ (I have admired his work since reading his treatment of the 1929 Wall Street Crash) could provide us with an approach on how the Government might take action to address the cost-of-living crisis, in a wartime context.

Towards the end of The Second World War, the UK was faced with recession and a real danger of runaway inflation, and thereby had a need for State Control of prices, rents and wages.

The wartime solution was to supplement the price controls with a fairly comprehensive system of rationing that extended to canned goods, meats, sugar, shoes, car tyres and petrol. Whilst in WW2 rationing was implemented via coupons and ration-books, nowadays a digital version combined with Tech-based insight re the consumer buying and usage behaviour would probably result in a 100% leak-proof and fair system for all… Incidentally, where supply was exceptionally short and need exceptionally great, demand was thus brought forcibly into equilibrium with supply, thus eliminating a major cause of inflation.

As you know there are two ways of increasing profits, even in wartime. One way is to raise prices, the other to increase production, As Galbraith noted, price controls and associated wage restraints made the increase of production the only available course. Profit maximisation was served horizontally by more production, not vertically by higher prices, a lesson for all…

Monetary policy (interest rates):

To make all of this work, apart from managing consumer and

business compliance, it would be necessary to keep interest rates low,

effectively freezing interest rates at say 1% for the next five years of

anticipated recession. This means that

any necessary borrowing by consumers or businesses would be at minimal interest

rates, with a modest reward for lenders…

Lenders would thus be forced to seek increased profitability

via increased efficiency and cost saving. Consumers would be encouraged to clarify and communicate real need, thus

minimising the advantages of product overlap and duplication by suppliers and

retailers, who would in turn seek and provide real differentiation and be

encouraged to make every sale count by delivering more than it says on the tin,

every time….

Fiscal Policy (Tax and Government expenditure):

In contrast with the lightweight Monetary policy outlined

above, the collecting of taxes and government expenditure would be much more

aggressive… This would be a combination of high taxes on the fortunate few that

have access to offshore means of tax avoidance, and Tech Giants that have

hitherto contributed little to the tax pool.

Incidentally, keep in mind that the top rate of tax in the

UK was 95% for many years, by no means unprecedented.

In addition, there could be excess-profits taxes applied to companies that have unfairly benefited from the Lockdown disruption of the past three years… This unprecedented clawback of money via taxation could be used to re-engineer/improve the NHS, and invest in improved provision of education for those in need. The excess cash could help to pay down National Debt and resource the negotiating of debt write-of/forgiveness where possible.

Incidentally, given the restraints on expenditure, consumers will probably save more, besides being encouraged to postpone expenditure by relatively stable prices. The resulting build-up of consumers’ unspent money could be absorbed via the sale of Government Bonds that could be redeemed for spending at the end of the recession…

The resulting lack of sleep, skipping of meals to provide

sufficient nourishment for hungry children, walking in all weathers to avoid

the cost of public transport while a family car remains empty at home because

of the escalating cost of fuel, will all add up to a national problem with a

far greater downside and a knock-on effect on national morale that will fast

become unmanageable…

An even greater casualty could be trust, a willingness to believe anything we are told. For instance, if part of the re-set agenda is to replace physical cash with its digital equivalent, then continuing with the current ‘abuse’ of money will compromise any hopes of a smooth transition. Moreover, given the move from the Gold Standard, money has become a fiat-currency, in that politicians are reliant on peoples’ belief in the value proclaimed by the government!

If people lose sufficient trust in the Government, there is a very real danger they could begin to require proof for any assertion made by anyone in officialdom, spending more time second-guessing any offering, any time, anywhere, any how….

Who knows, some could even begin to resist, and seek

alternatives…

Something clearly has to be done…

BTW, in terms of implementing its ‘wartime solution’ the Government might not find it difficult to achieve high levels of compliance with the above harsh regime. Best keep in mind the relative ease with which almost 100% of the UK public were fully supportive in terms of compliance re masks, social distancing, ‘jabs’ and viewing of 15 minute Government TV briefings each evening for the past 2.5 years…

All else is detail.

by Brian Moore (bmoore@namnews.com - www.kamcity.com)

#SoaringInflation #CostOfLiving #PriceRises

Sunday, 10 July 2022

Morrisons Updates Loyalty Scheme

Updates include the introduction of more deals in categories that shoppers appreciate savings in the most, including meat, dairy and impulse. The grocer will also offer its customers surprise offers such as flowers on Mother’s Day or sweet treats at Halloween.

Additionally, new Basket Bonuses will give shoppers that chance to ‘bag a bonus’ offer. This might be money off a shop or a treat from one of its Market Street counters.

Meanwhile, the look and layout of the My Morrisons app has also been improved to make it easier and quicker to use.

Over summer, members of the scheme will also be invited to participate in a six week ‘collector scheme’. This will enable them to receive a “significant money-off voucher” at the end of August if they have met the criteria and shopped in four of the relevant weeks.

“We know that this is a very tough time for customers and so our improved My Morrisons scheme will help the millions of customers who are part of it by rewarding them with instant offers when they shop,” said Rachel Eyre, Chief Customer and Marketing Officer at Morrisons.

“We have taken on board customer feedback about which categories are the most relevant and have also introduced unexpected surprises to put a smile on our customers’ faces.”

At the end of last month, Morrisons revealed that its like-for-like sales slid 6.4% during its first-quarter period to 1 May, with the group blaming a “very challenging” trading environment as inflationary pressures grow and consumer confidence weakened.

After the £7bn takeover of Morrisons by CD&R was recently given the green light by competition regulators, the group’s Chief Executive David Potts signalled his intention to start working with the new owners to help its customers through the difficult economic conditions.

However, analysts have suggested that the heavy debt pile picked up from the takeover deal could give Morrisons less flexibility to absorb increasing costs and restrict its ability to compete on price with its cheaper rivals.

NamNews Implications:

- Good to overhaul to shopper needs.

- The issue is how the add-ons will chime with shoppers unable to cope with the shelf impact of soaring inflation.

- Meanwhile, who knows the additional pressures/distractions of a debt pile with soaring interest costs…

- Watch this space!

Wednesday, 6 July 2022

Brand loyalty, built on honesty, could be the best policy in an unstable world…

Lockdown and its aftermath have brought about a destruction of trust in society. In fact, it could be said that the only residual trust is the faith people place in brands.

With the benefit of over two years’ hindsight, we can now see that one of the biggest casualties of Lockdown has been trust. Amidst all the turmoil of the past two years, the loss of faith in politicians, the judiciary, banks, traditional media and other institutions means consumers are increasingly checking ‘under the lid’ and taking nothing for granted, with ‘Buyer Beware’ now a default position…Since the global financial crisis of 2008, given 14 years of artificially low interest rates and mountains of printed money (so called ‘Quantitative easing’), we have been able to live and perhaps die beyond our means. Moreover, what started as emergency measures are now life support essentials for many businesses… If in doubt, watch while companies fall by the wayside as they have to return from the various tax and other ‘cost’ holidays granted during Lockdown and its aftermath, especially inflation-driven increases in interest rates as we pick up our obligations. We are fast approaching payback time, and it already hurts… In other words, many companies are in no state to produce sufficient ROCE to survive in the New Norm.

Meanwhile, consumers are trying to survive in a toxic mix of inflation and uncertainty on many levels. There is a mix of different degrees of inflation at different stages of the pipeline, some real, some the result of opportunism. Some caused by ingredient cost inflation, some resulting from having to substitute ingredients, thereby impacting the taste, but each inflationary element diluting potential sales.

All of the above are resulting in increased prices, putting us on a path towards 20% inflation and more. Inflation is being applied in many ways, all adding to the distrust and suspicion. Take the variety of ways of expressing a price increase on shelf. This can mean going for a straight one-off increase, hoping the consumer will accept paying more for the same amount of a well-known brand. Alternatively, we can try dithering bit-by-bit increases, hoping the consumer will not notice the price creep, and reach a point where rejection of the brand is the only option…

Then there is the Letter-of-Law vs. Spirit-of-Law option, shrinkflation. In effect, shrinkflation can be an outright attempt to deceive our most loyal consumer, the consumer that knows the brand specification almost as well as our technical team. The brand owner actually thinks a regular user will not notice the reduction in contents and that those that query and challenge the shortfall will accept our Letter-of -Law explanation of the weight change difference hidden in the small print, forgetting the danger of a loyal user deciding to get even rather than wasting breath getting mad. In shrinkflation, we thus have a recipe for destroying hard-won trust, at the very least…

It is a given that willing repeat-purchase by a regular user is the only real test of consumer (or retailer) need-satisfaction. Trust in the brand can guarantee increasingly profitable return visits of the consumer to the brand, requiring less and less persuasion to draw them back and retain their patronage. Moreover, given the encouragement of always receiving more than it says on the tin, we can even achieve a level of product satisfaction that moves the consumer to ‘tell-a-friend’ mode, effectively becoming a brand ambassador on our behalf. Key to this level of supplier-consumer relationship is complete trust in our brand…

So much for brand management pre-2020. However, in March 2020, as we have seen above, the introduction of Lockdown began the erosion of consumer trust in everything… In fact, consumers are also now approaching payback time as they enter the ‘New Norm’. They now have to view the world through a lens that reveals levels of inflation that few have experienced in their lifetime.

As a consequence, consumers, retailers and suppliers are being forced to re-evaluate everything, including their value systems, as they try to cope with rapidly rising energy, food and sheer living prices. The obvious signs are changes in how we measure what we believe is good value for money. In effect, we are looking afresh at how and where we buy. In practice, consumers are shopping more often, thereby wasting less. They are choosing different products (even own-label!), in smaller amounts, and are shopping closer not only to save petrol. Health and necessity are but additional factors in their decision-making…

A fundamental re-set is taking place at all levels in how the consumer assesses value, within a context of second-guessing everything, because they feel they can trust no one.

Lockdown and its aftermath has brought about a destruction of trust in society. However, it could be said that trust in a well-tried brand might be for many consumers the only truth among all the distrust…

In their quest for real value, consumers are seeking simplicity and consistency in their purchases, with choice of retailer being a slow-burn process in some cases. In fact, few will remember the arrival of a down-market small shop with a very limited range that dared to enter the sophisticated UK retail grocery market in 1990. And now, 32 years later, Aldi are actually pushing Morrisons off the No.4 spot of the mults’ ivory tower…

With consumers completely changing their way of measuring value, they are getting closer to a simple value for money assessment and are moving towards the ultimate simplicity, the discount offer. Then Aldi could move towards pole position, IMO.

Add the idea that anyone would ever trust their money to the Internet in order to buy online, let alone patronise a garage-based bookseller and allow them to grow to a 500m SKU offering of Amazonian proportions, all based on trust…

Trust in the brand can be a source of stability amidst the misinformation, and the more incredible the misinformation and official deception becomes, so it will result in less and less trust in the system, and the more a trusted brand will stand out.

Basic trust in the brand evolves over time, not because of reams of research, official assurance, or copious details on the label, but simply because of a combination of the brand name/logo, reliance on common sense and years of personal repeat usage giving me the confidence that when I remove the lid, the contents will even exceed my expectations, every time. In fact, a favourite brand can provide me with sufficient satisfaction that I will even recommend it to a friend...

That same trust and endorsement means my friend will not have to waste time second-guessing the offering. Also, given some degree of expectation-management to dilute my natural optimism, I will have hopefully started a new user on the road to years of brand satisfaction and loyalty.

Given the market turmoil, consumers are re-evaluating where they shop for real value. They are also second-guessing their sources of brand information, especially their use of traditional media. One simply has to check the 7% annual fall in newspaper circulation and moves from broadcast TV to an increasing variety of streaming services to appreciate that fundamental change is taking place in media usage.

However, it is only when one examines the emergence of Retail Media that it can be seen that a means of communicating with a hand-in-wallet shopper, in the aisle, at point-of-purchase, with a tailored message based on all a retailer knows about every aspect of that buyer’s buying and consumption behaviour, has to represent a complete break with the blunt message of traditional broadcast media. Only those with a brand marketing background will fully appreciate the size of threat that Retail Media represents for baggage-laden traditional media. That baggage means that consumers will increasingly trust and rely upon Retail Media in connecting with their brands…

Another trust-builder is emerging via Deliveroo. Now that home delivery has become Quick Commerce, and embraced Retail Media, the consumer can add Deliveroo to their sources of trust amidst the market turmoil (see Deliveroo launches ad platform). As Roger Dunn, Head of Retail Media at Criteo, says: “Deliveroo presents an exciting opportunity, especially for brands that are specifically relevant for quick commerce - so energy drinks, ice cream, and all those other impulse buys that don't necessarily stand out during a more considered weekly online shop, but consumers occasionally want... and quickly!”

We would add that it will be a big brand in a quick commerce category achieving spectacular success via the Deliveroo platform that will deliver a big ‘shot in the arm’ for Retail Media.

On balance, we believe that brand loyalty, built on trust, and always delivering more than it says on the tin, has to be your way of optimising your greatest asset.

Over to you…

Tuesday, 28 June 2022

A Brief encounter in Dublin:

Friday 28/06/1963 - Cycling home from work Smithfield Motors on her birthday, my wife Nora was prevented from crossing the Liffey to allow an open Limo with an attractive American to drive slowly past... His beaming smile + birthday wink converted Nora into a JFK fan to this day...

Aldi Heading For ‘Big Four’ As Morrisons And Asda Lose Ground

Given proof that Asda and Morrisons are losing market share as the cost of living crisis worsens, analysts have again raised questions over the impact of private equity ownership on the two chains.

As a result, both lost market share as Tesco and the discounters made gains.

Morrisons’ 10.1% share fell to 9.6% YOY, while Aldi is 9%, up from 8.2%. If this trend continues, Aldi will soon take its position in the Big 4.

Richard Hyman on This is Money website said it was now a question of “when, not if” Morrisons falls behind Aldi.

Meanwhile, Shore Capital retail analyst Clive Black said: “It’s not fanciful to suggest that by 2023 Aldi will be the fourth-biggest grocer in the UK.”

The differing fortunes of leading grocers will fuel fears private equity firms are not good stewards as consumers are squeezed by surging inflation.

Asda and Morrisons have been accused of raising prices faster than rivals, and experts say the heavy debt piles picked up during their takeovers give them less flexibility to absorb increasing costs.

Hargreaves Lansdown analyst Susannah Streeter said: “The discount grocers are snatching more customers from Morrisons and Asda, which seem to be falling behind in the competition to cut prices since being bought out.

“They went on a price offensive in April, but as they face an ever-tighter squeeze with costs mounting as they carry heavy debt loads, it’s going to be a lot harder to find room for fresh rounds of price cuts.”

Black also blamed the new ownership of Morrisons and Asda for the decline in sales and market share. He said: “They are profit maximisers and are clinical cash flow people. Whether they are getting the sums right between sales and margins, time will tell.”

The deals saw Morrisons saddled with £5.6bn of debt, while Asda’s buyout was funded with £4bn of debt.

Hyman blamed the exodus of senior leadership since the Issa brothers and TDR Capital takeover.

Hyman said Morrisons underperformance was “a bit more worrying”.

Earlier this month, CD&R’s £7bn takeover of Morrisons cleared its final regulatory hurdle, 8 months after completion. Potts said they could now work with its new owner on the path ahead, with it focused on helping its customers through the difficult economic times.

NamNews Implications:

- Given the consumer pain coming through the pipeline…

- …Aldi as No.4 is a running certainty.

- Asda & Morrisons “carry heavy debt loads, it’s going to be a lot harder to find room for fresh rounds of price cuts”

- …begging the question: are you giving your major customers the attention deserving of their new ranking?

- …and acknowledging their differences in business model?

#MarketShares #AldiRank

Sunday, 19 June 2022

Superdrug Benefitting From ‘Home Salon’ Trend

Superdrug has revealed that sales of at-home beauty devices and products have rocketed over the last year as consumers continue with habits picked up during the pandemic.

The health & beauty retailer highlighted that it had seen a surge in demand for hair removal devices, including a 103% rise in sales of Superdrug’s Studio Brow Razors (vs 2021), which following the latest dermaplaning ‘peach fuzz’ TikTok craze is now their best-selling items across its own brand make up accessories range.

Sales of the B. Brow Groomer are also up by 163% and Superdrug’s Male Grooming range has seen dramatic increases, with sales of their Men’s Nose Hair Trimmer increasing by 87% in the last year.

Superdrug has also seen an upsurge in the hair category, with at-home salon hair tools up by 38% (vs 2019) and hair rollers up by 81% (vs 2021).

Nailcare is also an area where Superdrug has seen strong growth, with sales up by 77% (vs 2021) as people turn to DIY nails. In particular, artificial nails have seen a 236% increase in sales, and

Superdrug now claims to be the number one supplier in the market.

The retailer noted that many consumers began their at-home beauty journeys throughout the pandemic, with manicures at home, following online hair tutorials, or how-to-wax guides. Superdrug pointed to research showing that 34% of shoppers replaced professional beauty and grooming treatments with DIY alternatives, and more than half of these (21%) intend to continue doing so. With the top two reasons being to save time and money, which comes as no surprise with the recent increased cost of living crisis.

Jamie Archer, Own Brand Director at Superdrug, said: “From looking at recent sales and how we have seen consumer shopping habits change in recent years, the home salon trend is here to stay. It’s been great to see these categories taking off and that the momentum is staying as shoppers look to experiment with beauty and try new treatments and looks.

“With the growth of TikTok our customers are able to trial a range of different trends from their homes, making beauty treatments even more accessible. We predict that we will continue to see growth in areas such as hair removal and DIY nails throughout the summer as the cost of living crisis continues, and we will continue to offer consumers a little bit of everyday luxury at cost-effective prices.”

NamNews Implications:

- Like ‘working from home’…

- …a genie has escaped the bottle in the case of home-grooming.

- And Superdrug are perfectly positioned to optimise the Home Salon trend.

- Especially as consumers begin to brag about the benefits…

- …and demonstrate them in their appearance.

Tuesday, 14 June 2022

The Untouched Cup of Coffee

#LastImpression #Hospitality #RepeatVisit

Saturday, 11 June 2022

Tailoring Major Customer Management by Business Model (Vive la Difference?)…

UK retailers now comprise two PLCs, two in Private Equity ownership, one Partnership, a Co-operative, and a strong probability that Boots will end up in PE hands, it seems logical that we should acknowledge that these fundamentally different business models should each be handled differently…

Given that they have different approaches to what success looks like, it seems natural that understanding their key drivers in the new norm and adjusting our approach to meeting those needs may help us gain a competitive advantage over our rivals that simply offer a ‘same size fits all’ option.

Their different business models cause retailers to have different business needs, to hear and assess our offerings from different perspectives, to have differing opinions re fair share, but more importantly, they are driven to behave differently based on the extent to which they perceive their needs are being met. Based upon the extent of these differences, making them an offer-in-common patently misses a trick in normal times. Making the same mistake in times unprecedented could be unrecoverable…

Clearly, differentiating these business models can help. Essentially there are five traditional retail business models operating in the UK (DTC and pureplay online are also present but will best be dealt with in a future NamNews article). These business models are PLC, Private Equity, Co-operative, Partnership and Private Company:

Public Limited Company (PLC)

Have shares traded on the stock market i.e. Tesco and Sainsbury’s. They are driven by Price to Earnings ratio (P/E), Share Price, in turn driven by Return On Capital Employed. ROCE is a multiple of Net Profit BT/Sales and Sales/Capital Employed i.e. Stockturn. They are also very focused on minimising Corporation Tax (For a detailed treatment of ROCE, see Finance in major customer management In other words, as you know, a PLC can be a low margin, fast rotation business or a high margin, slow rotation business. All that matters is the combination of margin and speed of rotation in producing an acceptable ROCE.

In selling to a PLC, it is worth keeping in mind that they are interested in what you do to improve their P&L i.e. Increase their sales, and reduce operational costs – in fact, reduce their business costs (including credit period) to improve their NPBT. They rely on small, frequent and accurate deliveries. They are obviously interested in your direct trade investment and increasingly interested in your use of retail media. In fact, retail media’s precision, impact and productivity at the point of purchase can make your retail media spend act in both your interests (See Alexander Knapman’s Retail Media summary on page 3). The PLC retailer obviously regards your brand as a means of attracting your consumer to the aisle to be confronted by their better-priced own-label equivalent. However, they also see your need to optimise your use of their retail media.

A PLC retailer operates entirely differently to a PE-retailer…

Private Equity Owned Retailer: i.e. Morrisons, Asda, Boots.

They are driven by Earnings Before Interest, Depreciation and Amortisation i.e. EBITDA. Think typical P&L starting with sales, then come the direct expenses (i.e. costs of generating sales, manufacturing/buying goods followed by sales and administration expenses. Then comes the EBITDA line, below which are Interest, Tax, Depreciation and Amortisation. Anything below the EBITDA line does not affect the valuation of the business, providing sufficient cash is generated to meet interest payments.

PE owners are less driven by net profit before tax because the nature of the business model means that the high cost of borrowing to buy the company results in little or no corporation tax being paid in the typically 5 to 7 years of PE ownership. Moreover, the retail management team are usually heavily incentivised to ensure a 100% focus on the EBITDA driver. A UK PE-retailer is typically valued at 10x EBITDA in the open market (other industries/sectors have different multiples of EBITDA). In other words, a PE retailer wants you to help reduce operational costs and simplify their processes whilst driving sales. Like PLCs, they can see brands as a means of drawing shoppers into the aisle to

be confronted by a better own-label offer. Following takeover, they will inevitably take steps such as selling off as many shops as possible, and leasing back those that are or can be made more profitable.

Hopefully, it can be seen that a PE-retailer is run very differently [See The-implications-of-private-equity-takeover-of-a-mult ]from a PLC retailer, but both see business through a strictly financial lens…

Co-operative Retailing:

As you know, Co-operatives arose in response to a fundamental need in the community. The core values that underpin the co-operative model – self-help, democracy, equality, equity and solidarity – guide the way decisions are reached. Ideally, this means that the Co-op will buy to serve the needs of their members and the interests of their community will be factored into their business decisions. Moreover, their one-member, one-vote rule means that the interests of the largest shareholders do not trump the rest. This group emphasis has caused them to appear less efficient than ‘normal’ retailers in the past, but they have evolved a sustainable model that generates sufficient profit to survive and grow in the current climate. Their emphasis on bottom-line impact tends to be less overt, and cash is used more as a measure of productivity than an end in itself.

The Co-op is thereby radically different to a PLC and a PE retailer and needs to be treated accordingly, if only to spread your business risk over the various routes to consumer…

Partnership Retailing: i.e. Waitrose

The John Lewis Partnership is a 100-year-old model and began as an experiment to find a better way of doing business by including staff in decision making on how the business would be run. The principles for how the company should operate were set out, along with a written constitution to help Partners understand their rights and responsibilities as co-owners.

The founders wanted to create a way of doing business that was both commercial, allowing it to move quickly and stay ahead in a highly-competitive industry, and democratic, giving every Partner a voice in the business they co-own. Their profit-sharing scheme can help partners focus on goals in common but given that profit-share is a significant part of their remuneration package, then issues can arise at times of low profitability when partner share is reduced.

Moreover, in a rapidly changing retail environment, the mix of retail format i.e. combination of department store and food retailing can cause difficulties in shifting gear. Suppliers have to sell to Waitrose in ways that acknowledge the influence of department store thinking and can accommodate the inefficiencies of combined distribution in terms of out-of-stocks.

Suppliers have to factor the high level of shopfloor partner involvement and their sense of ownership into business strategies, whilst allowing for potential dilution of morale when profits are not deliverable, factors that are not often present in PLC and PE-retailer relationships…

Privately Owned Limited Company: i.e. Aldi

Think Morrisons in Ken Morrisons’ day before going public i.e. little or no borrowing, a focus on minimising tax, simplicity of execution and limited frills, and a straightforward, no-nonsense offering representing good value for money…

In essence, Aldi simply fitted into the model that Morrisons could have become. The key advantages of the private company model include being able to act without having to have the approval of outside shareholders. That said, survival in the current climate means being able to generate an acceptable ROCE, capital rotation and a net profit before tax. Big ideas cannot be financed if internal funds are insufficient, thus limiting expansion. Negotiations, usually with owners of the business can be tough, and are usually finance-based and often need to deliver demonstrable value for money. Thus it can be seen that privately-owned retailers are different to Partnerships, Co-ops, PE-retailers, and PLCs…

It is important, and in the current climate vital, that suppliers treat all these models differently, using an approach that acknowledges these differences in business needs, objectives, and what good looks like, in order to ensure that what they hear from your proposals resonates with their financial aspirations and delivers accordingly.

All else is detail…

Wednesday, 8 June 2022

Swedish Online Supermarket Launches In The UK Offering Savings On Brands Of Up To 60%

The business was founded in Sweden in 2014, but now operates stores in Denmark, Finland, and Germany, and has proved popular with cash-strapped consumers.

Motatos sells food that would otherwise have been thrown away due to modifications in packaging, seasonal changes, or short best before dates. It focuses on ambient goods such as soft drinks, snacks, household goods, pet food and personal care products.

It sells lines from leading brands such as Cadbury, Kellogg’s, Heinz, Typhoo, Walkers, Ariel, and Dove, with claims of savings of up to 60% against the “normal retail price”.

Motatos founder Karl Andersson said: “We’re really excited to be launching in the UK at this stage in our development. There’s so much opportunity here for consumers to be able to help reduce waste whilst also reducing their weekly spend, meaning they don’t have to choose between price and being environmentally conscious.”

Christabel Biella, Motatos UK country manager, added: “The cost of living crisis is affecting all sectors, and UK shoppers are looking for ways to cut down their monthly spend without compromising on all the brands that they love.

“With prices surging, Motatos is hoping to make a real difference to consumers by offering savvy savings, allowing them to be sustainability-minded and reduce waste. It’s a win-win.”

The site has a minimum order value of £20. Deliveries are free for orders over £40, with a £2.99 charge for those below that level.

NamNews Implications:

- The right offering, right timing, right brands, right target audience…

- Pressing the right buttons: Waste-reduction, environment-protection, Sustainability, savvy savings...

- Watch this one go…

Tesco Requesting ‘Back Margin’ Payments As Part Of Price Negotiations

The change comes as supermarkets face CPI requests from suppliers looking to offset surging commodity and energy costs.

A source is quoted by The Grocer as saying: “Before Dave Lewis came in, Tesco had an extraordinary number of ways of charging suppliers. But that completely changed and has been minimal ever since.

“However, they’ve obviously got a tsunami of suppliers coming to them looking to increase prices and so they have brought back margin into discussions.

“It’s actually quite a clever thing to do because, with the desperation of suppliers to get CPI through, many are going to accept this.”

It is believed that Tesco is offering a sliding scale of charges on promotions, such as positioning on gondola ends or in-aisle shelf markers.

Ged Futter, founder of consultancy The Retail Mind, told The Grocer that Tesco’s move was “legitimate” but urged suppliers to stand firm in negotiations and not allow a retailer to couple CPI negotiations with requests for fees for promotions.

Meanwhile, Tesco stated that it currently only operates five forms of back margin, compared with 24 in 2015. Its Chief Product Officer Ashwin Prasad is quoted by The Grocer as saying: “We’re working with our supplier partners to navigate the pressures of inflation and deliver the best possible value for our customers.”

NamNews Implications:

- A reminder:

- Front Margin: the margin that you get from the party to whom you sell the product, i.e. sell side.

- Back Margin: the margin that you get from the party from whom you purchase the product i.e. Buy side

- A reminder:

- Avoid this return to the ‘old days’.

- It is the precedent that counts…

- …and should be counted.

- i.e. ‘Eyes wide open’ even with trade partners…

Major Oil Producer Eyeing MFG Forecourts

City sources are quoted as saying that ADNOC had yet to make a firm decision about whether to bid ahead of an initial deadline this week. However, they said it was preparing to hire JP Morgan to advise it on its interest in the UK company.

ADNOC, which is among the 20 biggest oil companies in the world, would be a significant player in a bidding war for a company that has rapidly grown its estate and profitability under the ownership of Clayton, Dubilier & Rice (CD&R), which acquired Morrisons last year.

If ADNOC does bid for MFG, it is expected to face a fight with Fortress Investment Group and Macquarie, the Australian financial services behemoth which recently bought Roadchef, the motorway services operator, for about £1bn.

However, Sky News noted that it was not certain a sale will go ahead given the difficult financing markets. Sources stated that CD&R will only proceed with a sale if it can secure an attractive valuation.

NamNews Implications:

- From a NAM’s eye view, MFG are heading for a period of uncertainty.

- Which will end upon receipt of an ‘attractive valuation’ (£5bn).

- Then a 6 month ‘Settling-in period’ following the sale.

- Meaning a probable shift to short term strategies/Initiatives by suppliers…

Irish Grocery Sales Fall As Inflation Reaches Nine-Year High

The drop came as grocery inflation hit 5.5%, the first time it has risen above 5% since August 2013.

David Berry, Managing Director for Kantar Worldpanel Ireland, said: “Food and drink prices are continuing to climb, and the impact of this on grocery budgets is now unavoidable for many people. Our research shows rising cost of living is a key concern for 81% of Irish consumers. A staggering 62% expect that they will have to cut back on the amount of food they buy in response to current prices. We’ll be seeing the effects of inflation for months to come.”

Shoppers are shifting their behaviour to manage the cost of buying food, including by turning to cheaper alternatives. Berry explained: “People are now making four fewer trips to the supermarket on average per month than they were this time last year.

Similarly, brands made up more than 50% of grocery sales in 2020 and 2021 … brands’ share of grocery spend dropped to 49% in the latest 12 week period, equivalent to a €29m fall.”

Despite the tough circumstances, people have been enjoying the recent warmer weather and are looking ahead to the summer months, with Berry noting: “Sales of BBQ meats, like burgers and sausages, and prepared salads have increased by 2% and 8%, respectively, in the latest 12 week period. Soft drinks have also seen a 5% boost this period, equating to an extra €5m through the tills.

It’s likely that sales of these items will keep rising as we make the shift to more summery foods and leave the soups and stews behind, but prices are going up too. A trip to the supermarket to buy BBQ meat, salad, and soft drinks will now cost €1 more on average in total than it would have last year.”

For the sixth consecutive period this year, Dunnes has retained its position as Ireland’s largest grocer, with a 22.3% market share. Berry continued: “Dunnes seems to be recovering well from the challenging COVID-19 period. The retailer’s current market share is now 1.2 percentage points higher than May 2021, boosted by 98,000 new shoppers in the latest 12 week period.”

Tesco is now slightly ahead of SuperValu in the race for second place, each accounting for 21.9% and 21.7% of the market. Tesco benefited from shoppers visiting the store more often, bucking the general market trend and allowing it to move just ahead of SuperValu.

Lidl holds a 13.1% market share this period. Aldi follows 0.9 percentage points behind, holding a 12.2% market share.

NamNews Implications:

- Inflation at 5.5% still has a bit to go.

- i.e. try what-ifs re 10% and assess the implications for your categories.

- “A staggering 62% expect that they will have to cut back on the amount of food they buy in response to current prices”, says it all…

- P.S. Note Lidl growth vs 2019…

Wednesday, 18 May 2022

Cost Of Morrisons Rescue Deal For McColl’s Revealed

Administrators’ documents show Morrisons paid the equivalent of £182m to rescue McColl’s.

Morrisons won by promising more cash for unsecured creditors and leveraging its position as McColl's main supplier.

McColl’s had an equity value of around £3m by the time its shares were suspended on 6 May. However, regulatory documents published by administrators PwC revealed that senior creditors were owed £160m.

PwC’s account of the chain’s final months show that four credible bidders had emerged for McColl’s, but that had narrowed to three by the time shares in the group were suspended.

The PwC document noted: “Any buyer would need to have the capacity to supply the entire store estate, possibly in a short space of time. All parties realistically capable of doing this had already been approached.”

Both EG and Morrisons submitted offers that included the retention of the entire estate of almost 1,200 stores, the rescue of McColl’s pension schemes, the costs of the administration, and full repayment of secured bank lenders and preferential creditors such as HMRC.

McColl’s had been in talks for several months with its lenders and Morrisons for financing to secure its long term future. In March, its Chief Executive Jonathan Miller stepped down after the business endured torrid trading conditions and supply chain issues that impacted its revenue and profit.

Commenting on the deal last week, Morrisons’ Chief Executive David Potts said: “...we believe this is a good outcome for McColl’s and all its stakeholders. This transaction offers stability and continuity for the McColl’s business and, in particular, a better outcome for its colleagues and pensioners.”

The wholesale agreement will continue without interruption.

McColl’s has converted 270 shops to Morrisons Daily, “fundamentally reshaping the business into a more profitable and sustainable model”.

In November, it announced that it would accelerate the number of conversions to 450 within a year.

The rollout is expected to continue and provide Morrisons with a significant presence in the convenience channel to challenge chains such as Tesco Express and Sainsbury’s Local.

NamNews Implications:

- In other words. Morrisons’ £182m offer covered:

- Retention of the entire estate of almost 1,200 stores

- The rescue of McColl’s pension schemes

- The costs of the administration

- Full repayment of secured bank lenders

- And preferential creditors (HMRC)

- It follows that McColl’s will be run on strictly financial terms going forward.

- All part of the New Norm…

- Key that suppliers run a financial check over major customers.

- i.e. given your exposure, what incremental sales would cover your credit exposure, if a customer got into terminal difficulties.

- In the process, why not reclassify your major customers as Invest, Maintain or Divest?

Thursday, 12 May 2022

Private Label Loyalists Now Equals Those Of Brands

Amid the current cost of living crisis, new research shows that supermarket private label loyalists (shoppers that buy them over 75% of the time) are now equal those of national brands loyalists in all key European markets.

According to a new report from IRI called Private Labels: Hiding in Plain Sight, around 50% of shoppers switch between both with most now appearing in the mid-income bracket, but also with high-income cohorts in France and Germany. Private label shoppers are looking beyond price. Where they intend to spend more or less in 2022 and beyond is in line with wider category trends.The study highlights that modern private label brands have evolved from their origins 40 years ago and developed into strategy-focused, differentiated, data-driven, and consumer-obsessed brands. Private labels are gaining ground in value sales, market penetration, consumer value and retail experience, while closing the gap on instantly recognisable national labels.

According to IRI, private labels now occupy a global category footprint of 16.5% of FMCG value sales. Driven by several growth factors, private labels are said to offer the same or better quality, affordability, healthier options, consumer acceptance, and portfolio stratification into Premium.

With the highest penetration in Spain (44%) and Germany (38%), private labels make up 35% of total FMCG sales in Europe, equating to €194bn. Germany records the highest absolute value (around €60bn), followed by the UK (€43bn).

The report notes that private labels have become a substitute in several growth categories for many national brands having undergone a significant transformation that focuses on quality, trust, environmental credentials, innovation, and delivery on claims.

In certain categories, such as beauty, vitamins and supplements, and alternative remedies for example, private labels often lead in innovation, which is then followed by national brands.

Ananda Roy, International Senior VP, Strategic Growth Insights at IRI, said: “Private labels may not be instantly recognisable brand names, but the fact is they don’t need to be. Retailers have re-imagined what consumers can expect from them in every supermarket aisle. They offer considerable value to shoppers who are not entirely price-driven by delivering quality, product performance and premium innovations which are comparable to the bigger, more established national brands.

“They compete for growth and margin on near equal terms and often present worthy competitors that are perhaps not fully acknowledged by the big brand owners. Private label brands are basically hiding in plain sight.”

Pandemic chaos causes sales to slide, but positive outlook ahead – Consumer buying behaviour amid pandemic chaos provided a transient boost to national brands, causing private label value sales to fall. During 2018-2019, private labels experienced strong value sales growth (+8% and +11.3% respectively). However, this tapered off during the early stages of the Covid crisis as consumers opted for trusted national brands amid uncertainty – value sales dropped 1% in 2020 (value share 35.2%) and 1.4% in 2021 (value share 34.6%).

However, IRI believes there is a distinctly positive outlook ahead as this trend is likely to be dampened and possibly reversed as national brands raise prices to counter inflationary headwinds and private labels return to growth.

Strategic drivers of growth – Growth in private labels has accelerated due to established retailer equity and trust, transparent pricing and consistent availability across national store portfolios. Edible and non-edible private label products are often manufactured under white-label arrangements alongside national brands. Consumers are receiving the same high-quality products they would if buying a national brand in terms of product performance, and in the case of edibles, taste, quality, and healthy options often match those of rival national brands.

Occasionally, if things do go wrong, consumers also receive the exact same consumer protections (returns, refunds and goodwill gestures) from retailers as they would from national brands. This has helped narrow the value and equity gap with national brands significantly.

Price wars looming – Small and mid-sized manufacturers are likely to lose consumers, volume and value to large manufacturers and private labels who are expected to mitigate inflation and maintain availability, despite ingredient shortages and supply-side disruptions. This creates the real possibility of price wars in the remaining half of 2022 with private labels having the potential to capitalise on inflationary trends.

Innovation is the new battleground – Private labels are often leading innovation in high-margin categories, such as Bakery, Beverages, Beauty, Vitamins and Supplements and over the counter healthcare remedies. IRI’s research shows that consumers found shopping in-store for private labels easier owing to clean labelling and clear ingredients. This made the experience more enjoyable and less confusing than having to shop amongst the confusing array and proliferation of packs, offers and formats among national brands. Shoppers say the gap between private label and national brands is narrower still when shopping online due to the platforms and mechanics being identical.

IRI expects new innovations to make private labels even more competitive as they take advantage of quick commerce, shoppable recipes, meal kits and leveraging retail media, all of which offer new routes-to-market, attraction of higher-income shoppers, and lower cost-of-sales.

Beyond retailers, Quick Commerce players are now creating their own private labels as seen recently in the UK by the launch of Jiffy’s bakery range.

Non-edibles lead recovery – Growth has been led by Italy (+3.4%) and Spain (+1%) and lagged in France and the Netherlands (-4%). However, there is evidence of a soft recovery, particularly in non-edibles, which is being driven by the easing of Covid restrictions. This has risen by 1.2% in value sales over the last five weeks.

Actions for manufacturers and retailers

As private label enters 2022 with a competitive tailwind, IRI has outlined several strategic opportunities and actions:

- Induce shoppers by trial and conversion of the 50% that regularly switch between private label and national brands.

- Further mining of loyalty data to enrich shopper segmentation and tracking.

- Invest more in retailer media to personalise promotions, experiences and track effectiveness.

- Promote private labels as ‘better value’ based on quality, trust, innovation and sustainability credentials.

- Make shopping for private labels quick, easy and fun by ensuring transparent pricing and clean labelling that helps clarify range, endorsements, innovative packaging and merchandising.

- Disrupt product experience and route-to-market which are less easily substituted.

- Partner with quick commerce leaders to create higher margins, bypass brands and distributors and create opportunities to offer a wider range of food and non-food products.

- If retailers obey the normal brand ground rules…

- …especially ‘always more than it says on the tin’…

- …and focus on repeat sales via loyals…

- …then own label sales and penetration will continue to increase.

- Largely at the expense of less focused brands?

- This IRI report is a worthwhile read…

Thursday, 5 May 2022

Cabinet Minister Tells Consumers To Buy Supermarket Value Brands To Cope With Living Cost Crisis

The cabinet minister that oversees food and farming has been accused of being out of touch after suggesting that consumers facing surging grocery and energy prices should buy supermarket value brands to cope.

After latest figures from the British Retail Consortium (BRC) showed that shop prices were increasing at their fastest rate since September 2011, George Eustice highlighted that the food industry was facing the knock-on effect of higher energy costs pushing up fertiliser and feed costs.

“Generally speaking, what people find is by going for some of the value brands they can actually contain and manage their household budget. It will undoubtedly put a pressure on household budgets and, of course, it comes on top of those high gas prices as well.”

He argued there was a “very, very competitive retail market with 10 big supermarkets and the four main ones competing very aggressively, particularly on some of the lower-cost, everyday value items for households, so things like spaghetti and ambient products – there’s a lot of competition to keep those prices down”.

Eustice added: “Where it gets harder is on things like chicken and poultry, and some fresh produce, where those increased feed costs do end up getting passed through the system because these people work on wafer-thin margins and they have to pass that cost through.”

Data released by NielsenIQ yesterday suggested that shoppers are already cutting back on alcohol and meat as household budgets come under pressure from the cost of living crisis. Consumers spent 7.8% less on chicken, beef, pork and fish in the four weeks to 23 April, whilst sales of beer, wine and spirits were down 15.9%.

Pat McFadden, a shadow Treasury minister, said Eustice’s comments were “woefully out of touch from a government with no solution to the cost-of-living crisis facing working people”.

He added: “People are seeing their wages fall, fuel and food costs rise, and families are worried about how to make ends meet.

It’s time for the government to get real help to people rather than comments that simply expose how little they understand about the real struggles people are facing to pay their bills.”

NamNews Implications:

- Presumably ‘Letting them eat cake’ is not an option…?

- People are being driven to buy value brands at Tesco, Morrisons and Asda…

- ..but may want to shop at Sainsbury’s, even Waitrose.

- This growing tension between Needs and Wants will cause problems…

Saturday, 30 April 2022

Sainsbury’s Plays Down Impact Of On-Demand Delivery Services

Alongside its standard online grocery operation, the supermarket sells its products via Deliveroo, Uber Eats and its own Chop Chop service.

However, Sainsbury’s Chief Executive Simon Roberts revealed yesterday that on-demand doesn’t generate major sales volumes.

He said: “It’s built through the course of the year but in total terms, the size of our on-demand business is a bit more than the equivalent of two of our supermarkets.”

However, Sainsbury’s is now facing competition from a raft of start-ups, including Jiffy, Getir, Gorillas, GoPuff, and Zapp that vying to win on-demand spend by offering deliveries within minutes of ordering.

This has prompted traditional supermarket groups to rethink their business models and team up with the rapid delivery providers.

Roberts said Sainsbury’s was waiting to see how growth progresses in on-demand as consumer shopping behaviour starts to normalise as Covid concerns ease.

However, he insisted he was pleased with how Sainsbury’s own Chop Chop delivery service was performing. “It’s a good way of using our convenience stores to fulfil those missions,” he said.

NamNews Implications:

- Nonetheless, Sainsbury’s have feet under the on-demand delivery table…

- With their own Chop Chop service to gain hands-on sharp-end experience.

- Whilst outsourcing cost via Deliveroo and Uber Eats as pace-setters.

- This combination of delivery options will provide Sainsbury’s with real insights that can optimise potential…

- One to watch and even get on board.

Thursday, 14 April 2022

Tesco Flags Continuation Of Discounter Price War; Sector Shares Crash On Inflation Hit Warning

Alongside its impressive annual results statement yesterday, the CEO of Tesco vowed to support shoppers “in their hour of greatest need” by continuing its price battle with Aldi, Lidl, and other discounters.

"(Consumers) are already planning changes to the way they shop, and we will make sure that we will be there to support them."The group noted that the final outcome depends on customer shopping habits, cost inflation levels in the months ahead, and the extent to which rising costs are absorbed or passed on to consumers.

Murphy highlighted that Tesco was managing to keep price inflation in its stores a “bit under the number for the overall market” as it battles the discounters that are gaining share by attracting cash-strapped shoppers.

Tesco have really strong levers through the Aldi price match, low everyday prices and Clubcard prices

He also noted that it was offering competitive prices on thousands of household and beauty items to stop customers from going to fast-growing chains such as Home Bargains and B&M.

“We plan to make sure we stay close to the situation and offer no reason to go anywhere else from a price competition point of view,” Murphy said. “That’s our commitment and that’s unwavering regardless of what happens in the market.”

He declined to say whether the business would be cutting prices further or be forced to increase them.

“We stay close to our suppliers and work with them to manage their input inflation but we are very rigorous about making sure that we don’t accept any cost that would be unnecessary."

The bleak outlook sent shares in all the listed grocery retailers tumbling and comes just a week after Morrisons cautioned that its sales and profits would be affected by geopolitical and inflationary pressures.

Sainsbury’s shares lost 2.5%, whilst Marks & Spencer shares tumbled 2.1% and Ocado’s slipped 2.6%.

Shore Capital retail analyst Clive Black downgraded his recommendation for Tesco from ‘buy’ to ‘hold’, and added that if the supermarket catches a cold he would expect others to catch ‘influenza’.

NamNews Implications:

- Aldi price match, low everyday prices and Clubcard prices will help fight the other mults…

- Meanwhile, Tesco determination to offer no reason to go anywhere else from a price competition point of view…

- …spells continuing price war in 2022…

- …no matter what happens in the market.

- Listed retailers fell approximately 2% yesterday, reflecting inflation and other market factors.

- Meanwhile, little/no mention of discounters’ ability to fund UK price cuts via global businesses to grow share…

Friday, 8 April 2022

Owner Of Morrisons Offers To Sell Petrol Stations To Ease Competition Concerns

Whilst the takeover has already been completed, the regulator had ordered all parties to remain separate and hold off on integration plans until its probe had taken place.

Concerns centred around CD&R also owning the Motor Fuel Group (MFG), the largest independent operator of petrol stations in the UK with 921 sites under brands such as Esso, BP, Shell, Texaco, Jet and Murco. Meanwhile, Morrisons operates 339 petrol stations, the vast majority of which are located at its supermarkets across the country.

The CMA announced last month that it found the deal raises competition concerns in relation to the supply of petrol and diesel in 121 local areas across England, Scotland and Wales. These are all areas in which MFG and Morrisons both have petrol forecourts and would face only limited competition after the merger, meaning that the deal could lead to an increase in prices.

Facing the prospect of a full Phase 2 investigation, it was announced yesterday that CD&R has now offered to divest a number of the petrol stations to gain approval for the takeover.

While the competition watchdog did not disclose how many sites the private equity firm was offering to sell, it said: “There are reasonable grounds for believing that the undertakings offered by CD&R, or a modified version of them, might be accepted by the CMA”.

Similar concerns were raised when the Issa brothers bought Asda due to their ownership of the EG forecourt empire. The CMA eventually forced them to sell 27 petrol stations to get the Asda deal across the line.

Recent reports have suggested that CD&R wants to sell off the entire MFG business via a £5bn auction, with another private equity firm the likely buyer.

NamNews Implications:

- A no-brainer decision (given the stakes involved…)

- Therefore proactive suppliers (and retail rivals) will have already factored this outcome into their trade strategies…

- …hopefully.

- Meanwhile, a what-if re CD&R selling off the entire MFG business via a £5bn auction is worth conducting.

- NamNews subscribers See 'Moving from Managing a Traditionally Owned to a PE Owned Mult'

.jpg)