We all await - with bated breath - the extent of Tesco’s property write-down at Dave Lewis presentation of the annual results tomorrow. This will be the first official acknowledgement of the structural changes that have taken place in UK retailing, and at City estimates of £3bn+ the impact on Tesco’s Balance Sheet and the market will be fundamental.

...with other mults needing increasingly persuasive arguments for not following suit…

In round numbers, think 20% reduction in large space retail

Why the write-down?

As you know, large space UK retail works on the premise that sales per sq ft of £1,000 per annum are sustainable

Undershooting presents three alternatives:

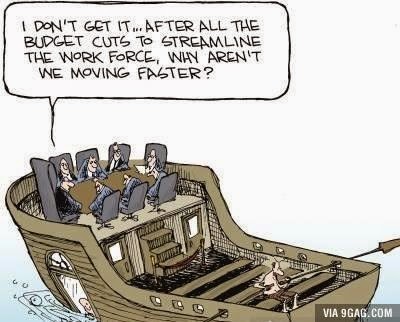

What can suppliers do about it?

...with other mults needing increasingly persuasive arguments for not following suit…

In round numbers, think 20% reduction in large space retail

Why the write-down?

As you know, large space UK retail works on the premise that sales per sq ft of £1,000 per annum are sustainable

Undershooting presents three alternatives:

- Sell ‘em, Close ‘em or Convert ‘em…

- Selling = ‘sell-off’ in an over-spaced market, Closing = write-off dilution of the bottom line, leaving fundamental Conversion as the only option…

- Action: Amazon permitting, the way forward for the mults has to be via conversion of large outlets to collaborative ‘shopping centres’ based on partnerships with specialist retailers in non-food categories, leaving grocers to sell groceries…

What can suppliers do about it?

- Short-term: Scope for any instore theatre at big venues, and best bit-parts locally

- Medium-term: Scope for demonstrably productive instore theatre, all venues, based on a sales/sq. ft. KPI

- Long-term: Think 1:1 consumer entertainment…